SMTrack Berhad ("SMTrack") is a dynamic and innovative company that has been publicly listed on the ACE Market of Bursa Malaysia Securities Berhad since 2011. The company's Initial Public Offering ("IPO") saw on overwhelming response, with shares being over-subscription rates on the Malaysia Stock Exchange.

SMTrack's core business is rooted in the Information Technology ("IT") sector, where the company specializes in providing cutting-edge online tracking and trace solutions. By leveraging state-of-the-art Radio Frequency Identification ("RFID") technology, coupled with an advanced tracking engine known as SMTrack, the company has carved out a niche for itself in the realm of asset and logistics management. This platform has become synonymous with precision, efficiency, and reliability, helping businesses across various industries track and trace goods and assets with ease and accuracy.

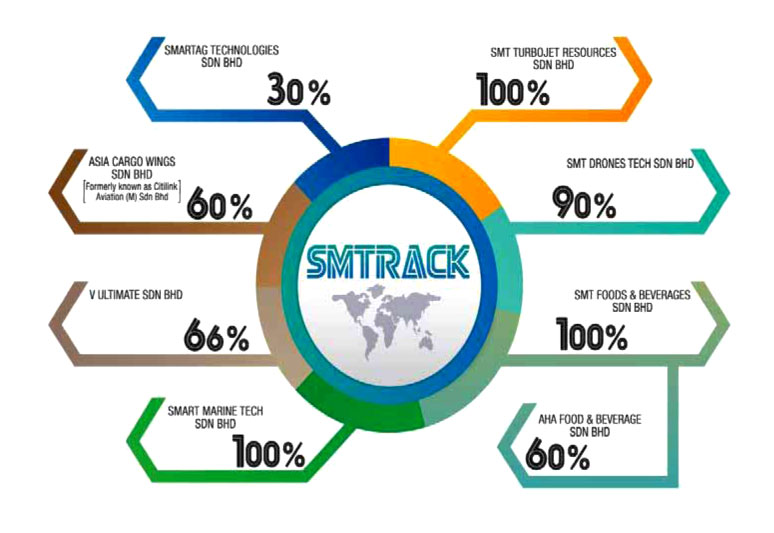

In 2019, SMTrack made a strategic move to diversify its business portfolio by acquiring Asia Cargo Wings Sdn Bhd (formerly Citilink Aviation (M) Sdn Bhd), a subsidiary focused on airfreight services. The acquisition was driven by the growing demand for air cargo services, particularly at Kuala Lumpur International Airport ("KLIA"), a key logistics hub in Southeast Asia. SMTrack's fleet, which includes Boeing 737-400 series aircraft, is strategically positioned to minimize operating costs while maximizing revenue through efficient and reliable air cargo services. The company has also entered into a business collaboration with Cainiao, enhancing its capability to cater to the increasing demand for air cargo services, particularly for e-commerce transactions and the transportation of high-value goods.

Looking to the future, SMTrack anticipates stable growth in the air cargo sector, underpinned by the continued expansion of international trade and e-commerce, along with the increasing use of air cargo for shipping high-value, low-weight goods.

In 2022, SMTrack, a company primarily known for its operations in the tracking and technology sectors, expanded its business portfolio by entering the beauty and wellness industry. This strategic move was made through a partnership with Gan and GWT Wellness Sdn Bhd. As part of this agreement, SMTrack acquired a 30% equity stake in V Ultimate Sdn Bhd, a company involved in the beauty and wellness market. The value of this stake was RM18 million.

Furthermore, SMTrack is currently in the process of further consolidating its position in the wellness sector. The company is actively working toward taking full control of V Ultimate Sdn Bhd by acquiring the remaining 70% of the company's shares, ultimately bringing its total stake in V Ultimate to 100%. This acquisition would mark a significant step in SMTrack's expansion strategy and solidify its presence in the beauty and wellness market.

In 2023, SMTrack broadened its portfolio again by venturing into property development, oil and gas ("O&G"), and food and beverage ("F&B") businesses. This diversification is aligned with the company's strategic goal of expanding its revenue streams and creating a more resilient and diversified business model.

Property Development: SMTrack's entry into property development is driven by the optimistic outlook forthe sector, which is recovering post-pandemic. The company sees significant potential for generating newincome streams and building a stable income base through this sector, which is experiencing a rebounddue to the reopening of the economy and national borders.

Oil & Gas ("O&G") : In the O&G industry, SMTrack aims to improve its financial performance and reduce itsreliance on its existing businesses by tapping into the lucrative support services segment. The company'sexpansion into O&G is expected to help broaden its service offerings and enhance long-term growthprospects.

Food & Beverage ("F&B") : The F&B business is anticipated to be one of SMTrack's more stable ventures.Given the growing consumer demand for food services and the company's strategic approach, SMTrackbelieves that its F&B segment will contribute positively to its earnings. Furthermore, the company benefitsfrom a profit guarantee stipulated under a Share Sale and Purchase Agreement (SSPA), ensuring a stableincome flow from this new business division.